|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

We conduct business in a wide variety of social and business cultures and in a broad range of political environments.

We conduct business in a wide variety of social and business cultures and in a broad range of political environments.

As a commercial organisation, our governing objectives are to provide a satisfactory return on our shareholders' capital, to invest in social and political environments. We do this by having a talented and motivated staff who offer our customers competitive services and products. We meet our financial obligations, we invest to develop our business for the future; our investments are made primarily on a financial basis, but with regard to the principles and values set out in this document.

IFC has always striven to maintain the highest ethical standards; this statement explains our approach. However, it cannot cover every eventuality.

IFC's policy is not to make contributions to political parties or partisan organisations. IFC works co-operatively with host governments and regulators while remaining politically neutral in all jurisdictions.

IFC codifies its key business principles and values in its Group Standards Manual which is in force throughout our operations.

The investment objective of IFC, is capital appreciation substantially above market averages, while seeking to secure the principal investment capital. No assurances can be made, however, that such returns will actually be realized, and that the principal investment capital will not be subject to loss.

The Firm seeks to achieve its investment objective by utilizing specialized traders to perform "riskless principal" transactions involving privately placed capital market and/or money market Securities which are unregistered and generally exempt issues. In a "riskless principal" transaction, when a trader purchases the Securities, he or she has already lined up (contracted with) an investor-buyer who has agreed to the terms of the resale (the secondary private placement, or "on-sale") at a beneficial higher price (the "spread"). By contracting for the resale of the Securities prior to their purchase, the trader is executing a type of arbitrage transaction, which virtually eliminates the market, liquidity, credit and other risks which would be present in traditional trading of privately placed Securities.

The Firm seeks to achieve its investment objective by utilizing specialized traders to perform "riskless principal" transactions involving privately placed capital market and/or money market Securities which are unregistered and generally exempt issues. In a "riskless principal" transaction, when a trader purchases the Securities, he or she has already lined up (contracted with) an investor-buyer who has agreed to the terms of the resale (the secondary private placement, or "on-sale") at a beneficial higher price (the "spread"). By contracting for the resale of the Securities prior to their purchase, the trader is executing a type of arbitrage transaction, which virtually eliminates the market, liquidity, credit and other risks which would be present in traditional trading of privately placed Securities.

The Securities are purchased through a process called "reverse inquiry." In a "reverse inquiry," the trader generally relays the "inquiry" (the request for presently un-issued Securities) to the issuer of the Securities through the issuer's agent. This type of purchase is Payment Versus Delivery (PVD, or "funds first") because, the funds which will be used for the purchase, must be evidenced by the trader before the issuer will "cut" or issue the new Securities. The "on-sale" to secondary private placement market investors-buyers of the Securities is a Delivery Versus Payment (DVP, or "collateral first") transaction. The trader may also purchase Securities "collateral first" in the secondary private placement market for "on-sale" to other secondary private placement market investors-buyers, also on a "riskless principal" basis. Generally, clearance and settlement of the Securities are "book-entry." When Securities are issued or transferred in "book-entry" form, the descriptive information and settlement details are entered electronically, with no issuance or movement of physical certificates.

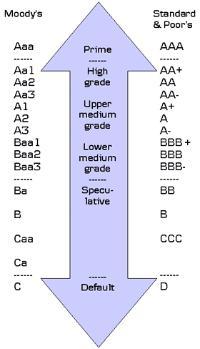

The privately placed Securities vary in name and are issued in accordance with internationally acceptable standards for securities and negotiable instrument formats as adopted by various relevant regulatory agencies. These privately placed securities and/or negotiable instrument formats may include: Medium Term Notes (MTNs [example] and Euro-MTNs [example]), Structured Notes, Bank Notes, Banker's Acceptances (BAs), Certificates of Deposit (CDs), Interest Guaranteed Contracts, Government Bonds, Industrial Development Bonds, Municipal Bonds, Asset Backed Securities (ABS), as well as other debt instrument variations, as well as Common Stock, Preferred Stock and other direct and indirect equity ownership interests in corporations and other entities ("Equities"). With the exception of Asset Backed Securities (ABS) and Equities, the Securities are generally senior unsubordinated debentures, backed solely by the creditworthiness of the issuer. Although these privately placed Securities are unregistered and generally exempt issues, they are typically rated, or privately evaluated to be A, its equivalent or better. Many of the Securities are credit enhanced (guaranteed) by large money-center banks through various methods, and may carry the credit rating of the issuing/guaranteeing bank. The issuers of the privately placed Securities may include: U.S. and foreign corporations, financial institutions, industrial companies, federal agencies, supranational institutions and sovereign countries. The secondary private placement investors-buyers may include: banks and bank trust departments, insurance companies, securities houses, mutual funds, investment advisors, state and local governments, central banks and government agencies.

The privately placed Securities vary in name and are issued in accordance with internationally acceptable standards for securities and negotiable instrument formats as adopted by various relevant regulatory agencies. These privately placed securities and/or negotiable instrument formats may include: Medium Term Notes (MTNs [example] and Euro-MTNs [example]), Structured Notes, Bank Notes, Banker's Acceptances (BAs), Certificates of Deposit (CDs), Interest Guaranteed Contracts, Government Bonds, Industrial Development Bonds, Municipal Bonds, Asset Backed Securities (ABS), as well as other debt instrument variations, as well as Common Stock, Preferred Stock and other direct and indirect equity ownership interests in corporations and other entities ("Equities"). With the exception of Asset Backed Securities (ABS) and Equities, the Securities are generally senior unsubordinated debentures, backed solely by the creditworthiness of the issuer. Although these privately placed Securities are unregistered and generally exempt issues, they are typically rated, or privately evaluated to be A, its equivalent or better. Many of the Securities are credit enhanced (guaranteed) by large money-center banks through various methods, and may carry the credit rating of the issuing/guaranteeing bank. The issuers of the privately placed Securities may include: U.S. and foreign corporations, financial institutions, industrial companies, federal agencies, supranational institutions and sovereign countries. The secondary private placement investors-buyers may include: banks and bank trust departments, insurance companies, securities houses, mutual funds, investment advisors, state and local governments, central banks and government agencies.

If you are interested in the "Money Creation Procedure" please see the following presentation.

Investment Philosophy

Investment Philosophy

The Firm's focus is on performance, resulting from exploiting the profit opportunities unique to its investment objective and strategy, rather than exploiting the profit opportunities arising from large scale "asset gathering" and base management fees (usually 1-2% of assets, paid quarterly) and/or sales charges in which most other investment management organizations place their primary emphasis. The Firm's performance based approach is evident in its unconventional fee structure. The Firm will not charge any asset-based management fees or sales charges and will pay its own expenses. The Firm is very confident in its ability to successfully implement the investment strategy over the long-term and thus feels that it is appropriate to demonstrate this by providing investors with a large "Hurdle Rate" of 10% before allocating the retroactive Preferred Profit Participation fee of 20% to the Firm's account.

The Firm recognizes that extraordinary profit potential is often found in complicated and misunderstood markets, such as the international private placement market, and that there are many special situation investment opportunities privately available to well placed and well informed investors. The Firm employs the tools and techniques necessary to realize these profits, and will identify and evaluate potential opportunities while effectively managing the risks inherent in the global capital markets and money markets. The Firm will provide a means by which sophisticated investors can access these potential returns, by participating in investment activities utilizing the proprietary informational and strategic advantages possessed by the Firm.

Investment Policy

The Firm's investment policy could aptly be summarized as: Protect the principal investment capital.

Each potential transaction is carefully analyzed in accordance with a pre-determined formula for maximum safety and profitability. In all cases the Firm controls risks at the banking level, seeking to ensure that the Investor's greatest risk is limited to the potential failure of the selected depository institution. In a "riskless principal" arbitrage transaction, when a trader purchases the Securities, he or she has already lined up (contracted with) an investor-buyer who has agreed to the terms of the resale (the secondary private placement, or "on-sale") at a beneficial higher price (the "spread"). The exposure to many risks associated with trading Securities are virtually eliminated due to the extremely short period the Firm/Investor technically owns the Securities or an interest therein. The Firm also employs certain proprietary methods to "transfer" and manage risks, maintaining the principal investment capital.

Looking after our customers is basic to all our business relationships. We promise only what we can deliver and we strive never to mislead our customers. In conducting business with due skill, care and diligence, IFC seeks always to comply with both the letter and the spirit of relevant laws, rules, regulations, codes and standards of good market practice.

We address any irregularities that arise promptly, we seek to resolve them promptly in a way that protects our reputation and minimises financial loss. We believe in transparency in our financial and regulatory reporting with swift disclosure of any breaches. We co-operate with supervisors and regulators to attain and maintain the highest operating standards to safeguard the interests of our customers, our shareholders, our staff and the communities where we operate.

IFC supports the general policies set out in the OECD Guidelines for Multinational Enterprises, which are designed to ensure that we operate in harmony with the policies of the countries in which we operate. We support and comply with the Statement of Principles issued by the Basle Committee on Banking Regulations and Supervisory Practices. We support the policies and procedures of the Vienna and Strasbourg Conventions against drug-trafficking and money-laundering, and also the various United Nations conventions and resolutions combatting terrorism.

IFC supports the general policies set out in the OECD Guidelines for Multinational Enterprises, which are designed to ensure that we operate in harmony with the policies of the countries in which we operate. We support and comply with the Statement of Principles issued by the Basle Committee on Banking Regulations and Supervisory Practices. We support the policies and procedures of the Vienna and Strasbourg Conventions against drug-trafficking and money-laundering, and also the various United Nations conventions and resolutions combatting terrorism.